So the top 1% of taxpayers pay 15% of the tax, and the top 3% pay 26% of the tax? Does it mean we overtax our rich?

No, and I'm sick of writing about it. So, here are some interactive pies I prepared earlier. The angle shows income distribution (the broader the slice, the greater their share of the total income). The area shows tax distribution (the bigger the slice, the more they contribute to the total pool of income tax). If this doesn't make sense to you, compare the NZ graph with the equal income and flat tax graphs. Under a flat tax system, it looks like a normal pie graph, so all the distortions show the progressive tax system at work.

You can also click on each slice to break them down further. (Click outside the pie to zoom back out.) You need Flash to see this properly. You can get Flash here

The points are:

* Rich people have a very big slice mainly because they have a very broad slice. That is, they pay a lot of tax because they make a lot of money. Duh.

* Rich people get taxed more on their income (their slice sticks out more). That's because we have progressive tax systems. Duh.

* How progressive? At the top end, New Zealand's tax system is less progressive than Australia. Rich pricks in Australia pay more than they do in New Zealand, both proportionally and in absolute terms.

* At the bottom end, New Zealand's tax system is *far* less progressive than Australia. If you zoom in to the bottom 50% (i.e. Click on it), you'll see that Australia curves in very quickly – that's because the first $6,000 of income is tax free, which means that poor pricks pay very little tax.

* On top of this, Australia's bottom 50% have a bigger share of the total income. This is not a tax issue, nor about the income disparity between New Zealand and Australia. Income is more equitably distributed in Australia, even before tax is taken into account.

It's not some kind of tricky accounting. Australia has a tax-free bottom bracket, and at the top end, it goes all the way up to 45% (New Zealand's top rate is 39%). Australia's tax system is simply more progressive. This means it's low income earners who have a tax incentive to move to Australia, and 'rich pricks' who don't.

This idea that the

brain-drain is all about (or anything about) tax is just crap.

The other claims about New Zealand having an uncompetitive tax system are tougher to unwrap.

Does NZ have the third highest rate of personal tax in the OECD? Sure, if you don't count social security contributions. What social security contributions? Oh, right, New Zealand doesn't have that because we just pay it – i.e. Fund the welfare state – out of normal taxes. People in other countries pay a separate social security “tax”, a bit like the way we pay ACC separately.

It's a big chunk of the bill – when you include it for some countries and not for others, it's an entirely skewed picture, and doesn't represent what people actually pay, and what they take up.

Likewise, when our corporate tax rate is compared with other countries, it's never really comparable. Sure, we have “the third highest rate of corporate tax in the OECD”, but we also give these things called imputation credits. They're coupons for tax that's already been paid, so that shareholders get credit for tax that the company has paid, and don't have to pay it again.

Other countries don't have imputation credits clip half the tickets on each end – once when the company earns a profit, and again when that profit is doled out to shareholders. Of course, when you just look at this system and count half of it, New Zealand's rate will seem high by comparison.

So, does it mean that we should have a more progressive tax system? No. It means we should stop drawing simplistic conclusions from one-line statistics in op-eds.

Grump.

Notes:

* The graph uses 2007 IRD data because I could only get 2007 data for Australia, so it will be slightly different from the op-ed,

which cites 2008 numbers, I think.

* I was going to put UK stats in there as well, but they've aggregated their stats into a handful of very large brackets, which means it's impossible to extract accurate information on a granular level. If anyone has it (i.e. UK income and income tax distribution broken down by percentile, or by small income brackets) and don't mind sharing, I'd love to chuck it up too.

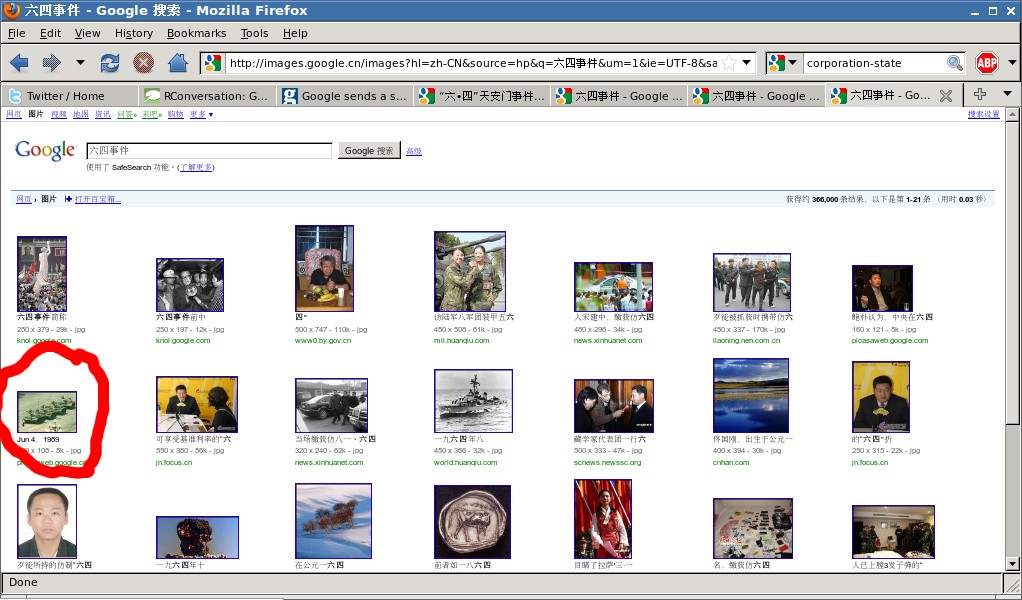

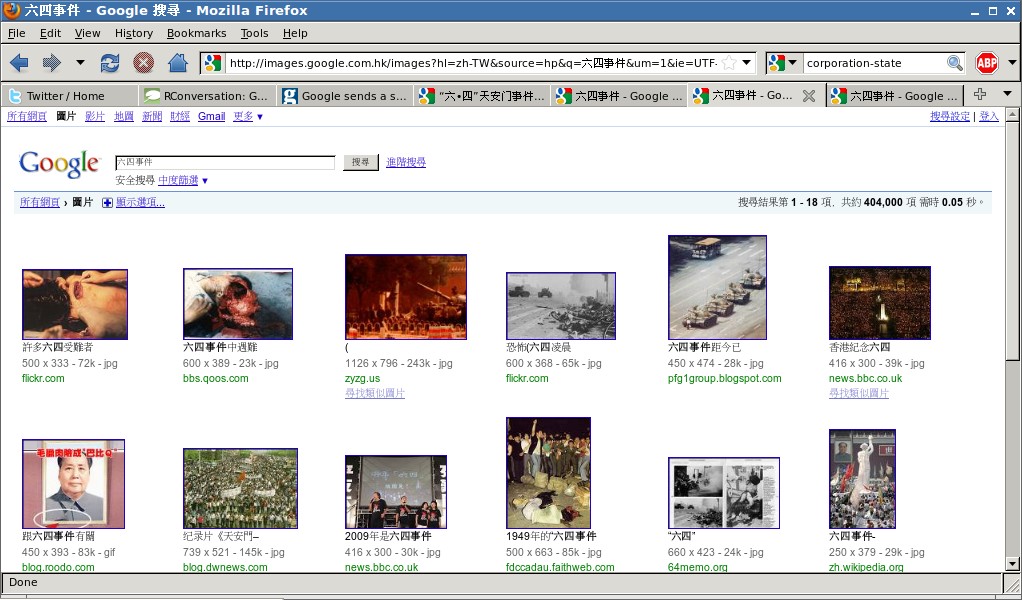

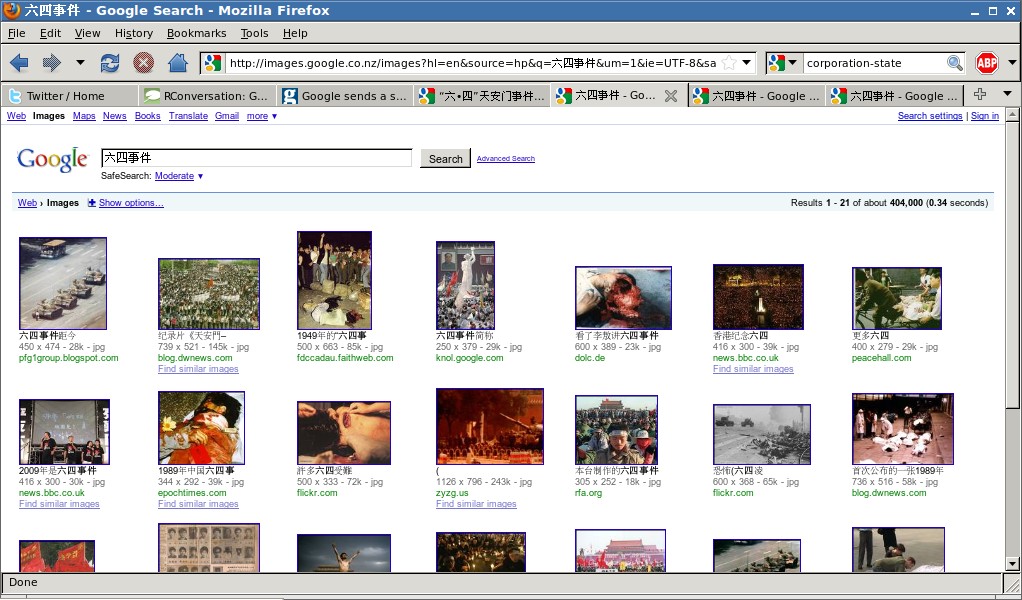

* This was going to go up two weeks ago, but the visualisation took longer than expected, and then Google vs China kinda took over. Here's the interview with Wammo: